Next, prepare the business records, which can be maintained on a software tool or manually on a spreadsheet. Compare the balance sheet’s ending balance with the bank statement’s ending balance. When you record the reconciliation, you only record the change to the balance in your books.

Transposition error

You have to go back and compare your records with the bank’s to try and figure out what went wrong so you can correct your records to match the banks. Incorrectly recording transactions in the accounting system can result in errors in the balance sheet and bank statement, making it challenging to reconcile. Bank reconciliation statements ensure that payments were processed and cash collections were deposited into the bank.

Adjusting the General Ledger Balance

If you’ve earned any interest on your bank account balance, it must be added to the cash account. You receive a bank statement, typically at the end of each month, from the bank. The statement itemizes the cash and other deposits made into the checking account of the business, as well as any expenses paid by the business. This includes everything from wages and salaries paid to employees to business purchases like equipment and materials.

- A bank reconciliation compares a company’s cash accounting statements against the cash it has in the bank.

- Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

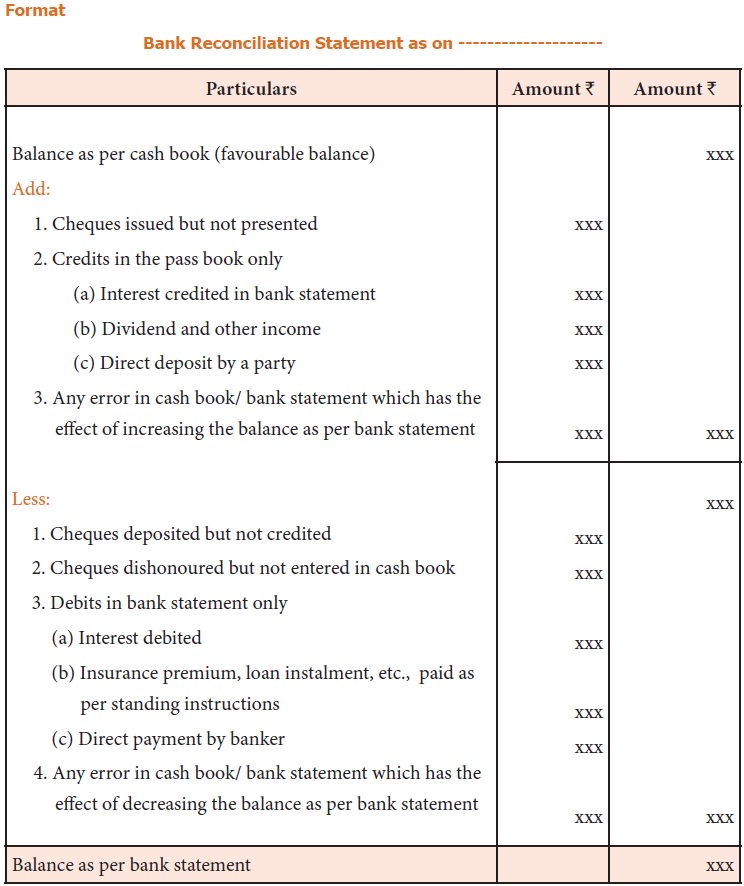

- The cash account balance in an entity’s financial records may also require adjusting in some specific circumstances, if you find discrepancies with the bank statement.

Step 1 of 3

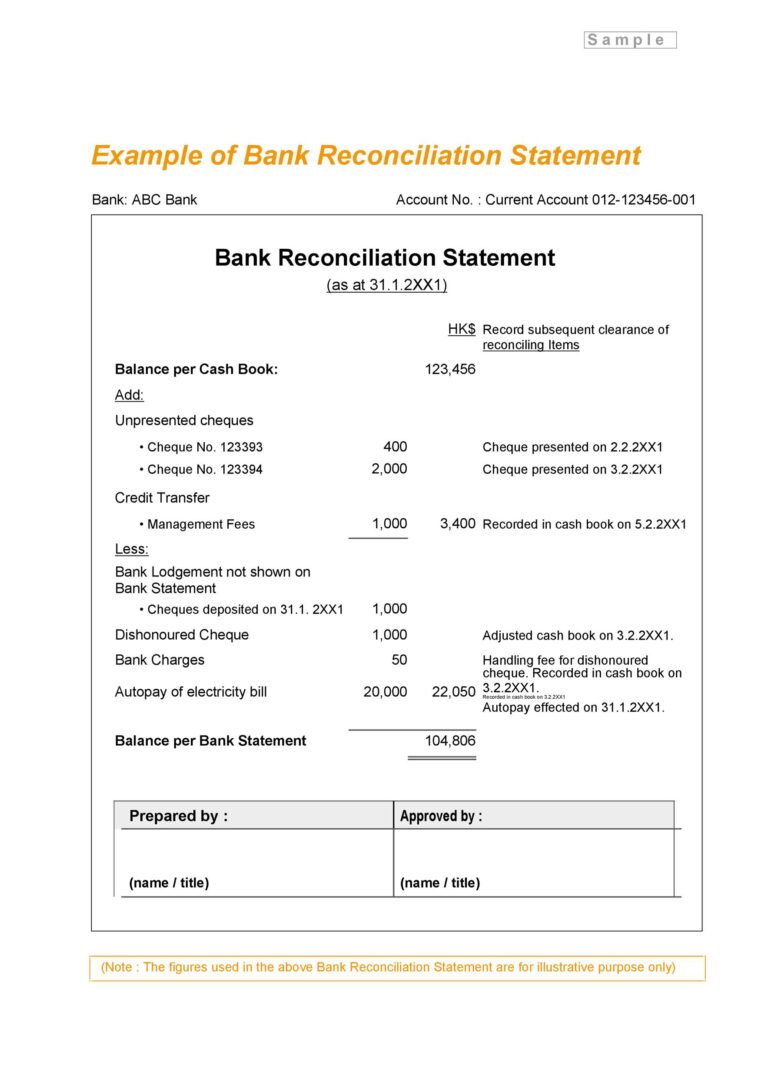

When your business issues a check to suppliers or creditors, these amounts are immediately recorded on the credit side of your cash book. However, there might be a situation where the receiving entity may not present the checks issued by your business to the bank for immediate payment. Now, such a figure will be shown as a credit balance in your cash book, however, in the bank statement, that balance will be showcased as a debit balance and is known as the debit balance as per the passbook. Next, check to see if all of the deposits listed in your records are present on your bank statement. After all adjustments, the ending balance of the cash book should equal the bank statement. (c) A deposit of $5,000 received by the bank (and entered in the bank statement) on 28 May does not appear in the cash book.

What Is a Bank Reconciliation Statement, and How Is It Done?

Once you determine the differences between the balance as per the cash book and the balance as per the passbook, you’ll need work out the balance as per the bank portion of the bank reconciliation statement. At times, your customers may directly deposit funds into your business’ bank account, but your business will not notified about this the bank statement is received. When you compare the balance of your cash book with the balance showcased by your bank passbook, there is often a difference. One of the primary reasons this happens is due to the time delay in recording the transactions of either payments or receipts. The purpose of preparing a bank reconciliation statement is to reconcile the difference between the balance as per the cash book and the balance as per the passbook.

Create a free account to unlock this Template

This is accomplished by scanning the two sets of records and looking for discrepancies. If you find any errors or omissions, determine what happened to cause the differences and work to fix them in your records. For example, if a company writes a check that has not cleared yet, the company would be aware of the transaction before the bank preparing a bank reconciliation is. Similarly, the bank might have received funds on the company’s behalf and recorded them in the bank’s records for the company before the organization is aware of the deposit. As of 30 September 20XX, the ending debit cash balance in the accounting records of Company A was $1,500, whereas its bank account showed an overdraft of $500.

Automation can solve the problem of time-consuming manual reconciliation and reduce errors. Cross-checking the bank statement and balance sheet can be done without human intervention using software tools. After checking all the critical items, adjust the cash balances to account for all expenses and transactions. For instance, if you haven’t reconciled your bank statements in six months, you’ll need to go back and check six months’ worth of line items. Whether this is a smart decision depends on the volume of transactions and your level of patience.

The need and importance of a bank reconciliation statement are due to several factors. First, bank reconciliation statements provide a mechanism of internal control over cash. One of the procedures for establishing the correct cash balance (and for controlling cash) is the reconciliation of the bank and book cash balances. The Substantiation software automates the reconciliation of general ledger and supporting balances.