The total assets for ABC Ltd amount to Rs. 77,50,000, while the total liabilities amount to Rs. 32,00,000. To calculate the book value, we subtract the total liabilities from the total assets i.e. This represents the net value of the company’s assets after deducting all its liabilities. A common way of increasing BVPS is for companies to buy back common stocks from shareholders. This reduces the stock’s outstanding shares and decreases the amount by which the total stockholders’ equity is divided. For example, in the above example, Company X could repurchase 500,000 shares to reduce its outstanding shares from 3,000,000 to 2,500,000.

Book Value Per Share Calculation Example (BVPS)

Increasing book value per share can be done in two ways; however, sound strategies are required for both in order to avoid a financial fallout. However, for sectors like technology and pharmaceuticals, where intellectual property and ongoing research and development are crucial, BVPS can be misleading. Investors use BVPS to gauge whether a stock is trading below or above its intrinsic value.

The Difference Between Market Value per Share and Book Value per Share

In some cases, you may have identified a company with genuine hidden worth that hasn’t been widely recognized. Failing bankruptcy, other investors would ideally see that the book value was worth more than the stock and also buy in, pushing the price up to match the book value. When deciding to invest in the market, it is important to know the actual share value of a company and compare it with market value and trends. This helps you better create a picture of the investment and how lucrative it will be for you in the long run.

Using Book Value in Investment Analysis

- This all-in-one solution allows you to track invoices, expenses, and view all your financial documents from one central location.

- In return, the accumulation of earnings could be used to reduce liabilities, which leads to higher book value of equity (and BVPS).

- If a business earns 500,000 and spends 200,000 of that money on assets, then the value of the common stock rises along with the BVPS as well.

- This situation suggests a potential buying opportunity, as the market may be undervaluing the company’s actual worth.

5paisa shall not be responsible for any unauthorized circulation, reproduction or distribution of this material or contents thereof to any unintended recipient. Kindly note that this page of blog/articles does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. This article is prepared for assistance only and is not intended to be and must not alone be taken as the basis of an investment decision.

The book value meaning in share market, more commonly known as net book value or carrying value, is a financial metric that represents the value of an asset on a company’s balance sheet. In other words, it is calculated by taking the original cost of the asset and subtracting the accumulated depreciation or amortization up to the current date. Consequently, it can be conceptualized as the net asset value(NAV) of a company, obtained by subtracting its intangible assets and liabilities from the total assets. Book Value Per Share solely includes common stockholders’ equity and does not include preferred stockholders’ equity. This is because preferred stockholders are ranked differently than common stockholders in the event the company is liquidated. The book value of common equity in the numerator reflects the original proceeds a company receives from issuing common equity, increased by earnings or decreased by losses, and decreased by paid dividends.

The Formula for Book Value Per Common Share Is:

Stock repurchases occur at current stock prices, which can result in a significant reduction in a company’s book value per common share. Here, common equity represents the total amount that the common shareholders have invested in a company. This figure represents the amount that is available after accounting for all the liabilities and assets of a company – the pay-out that the shareholders are entitled to receive. Applying logic, dividing the total pay-out with the total number of shareholders invested in the company gives the value of each share.

The best strategy is to make book value one part of what you are looking for as you research each company. You shouldn’t judge a book by its cover, and you shouldn’t judge a company by the cover it puts on its book value. Mutual Fund, Mutual Fund-SIP are not Exchange traded products, and the Member is just acting as distributor. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. Deskera Books hence is the perfect solution for all your accounting needs, and therefore a perfect assistant to you and your bookkeeping and accounting duties and responsibilities.

It’s important to note that the company’s stock is valued in the books of accounts based on its historical cost, not its current market value. Book value per share (BVPS) tells investors the book value of a firm on a per-share basis. Investors use BVPS to gauge whether a stock price is undervalued by comparing it to the firm’s market value what is the last in first out lifo method per share. Book value refers to a firm’s net asset value (NAV) or its total assets minus its total liabilities. A simple calculation dividing the company’s current stock price by its stated book value per share gives you the P/B ratio. If a P/B ratio is less than one, the shares are selling for less than the value of the company’s assets.

By analyzing BVPS, investors can gain insights into a company’s financial health and intrinsic value, aiding in the assessment of whether a stock is over or undervalued. Nevertheless, most companies with expectations to grow and produce profits in the future will have a book value of equity per share lower than their current publicly traded market share price. However, the market value per share—a forward-looking metric—accounts for a company’s future earning power. As a company’s potential profitability, or its expected growth rate, increases, the corresponding market value per share will also increase. A company’s stock is considered undervalued when BVPS is higher than a company’s market value or current stock price.

There is a difference between outstanding and issued shares, but some companies might refer to outstanding common shares as issued shares in their reports. Since a company’s book value represents net worth, comparing book value to the market value of the shares can serve as an effective valuation technique when trying to decide whether shares are fairly priced. BVPS is typically calculated and published periodically, such as quarterly or annually. This infrequency means that BVPS may not always reflect the most up-to-date value of a company’s assets and liabilities. By multiplying the diluted share count of 1.4bn by the corresponding share price for the year, we can calculate the market capitalization for each year.

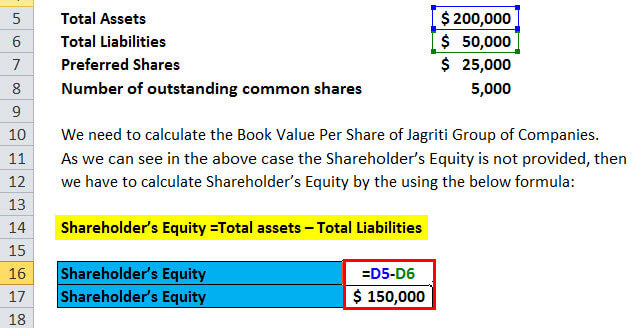

As a result, a high P/B ratio would not necessarily be a premium valuation, and conversely, a low P/B ratio would not automatically be a discount valuation when comparing companies in different industries. BVPS is typically calculated quarterly or annually, coinciding with the company’s financial reporting periods. The difference between book value per share and market share price is as follows. For example, if a company has a total asset balance of $40mm and liabilities of $25mm, then the book value of equity (BVE) is $15mm. As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from the latest financial report (e.g. 10-K, 10-Q).